So You Want to Build a Stock Trading App like Robinhood?

So You Want to Build a Stock Trading App like Robinhood?

A mental model for entrepreneurs on how to approach FinTech products from the technical point of view.

Outline

- Motivation — why I decided to write about building a FinTech product.

- Market’s overview — existing companies and how different they are from each other.

- Existing APIs — overview of the top API vendors.

- Stock Exchange Data — how and where to get data to show to your users.

- Real-time vs On-demand — on how it impacts your tech architecture and business model.

- Business model — how to make money with your FinTech product.

- Deposits and payouts — regulations and insurance aspects for the checking and saving accounts.

- Desktop vs Mobile — my opinion on how it should be done.

- Crypto — very short list of crypto vendors

- International and domestic markets — overview of foreign markets

- Where to go from here — summary of the FinTech mindset and API first businesses.

- Next steps

Who should read this article

- Founders wanting to break into the FinTech market in the US or overseas.

- Bankers who are tasked with launching new services or products.

- Brokers who are ready to launch their own brokerage.

- Fund managers who want to let their clients automate the trades on their platforms.

Motivation

Many of the clients at my software house are in the FinTech business. Weekly I get a question about starting a business in the stock-trading space or adding functionality to their existing products to expand into FinTech. This article’s purpose is to answer some of the frequent questions and provide guidance on how to navigate the decision-making process of building tech and business around FinTech product ideas.

Over the past decade, I’ve worked with diverse FinTech companies, helping them build tech teams, tech, and business around the finance products. Banks, insurance companies, funds, trusts, Blockchain companies, VCs… I’ve seen it all.

So how do you start building a FinTech product?

The process should start with research to find the niche your business would be able to control. The goal of your minimum viable product (MVP) should be finding and validating your product-market fit (PMF).

In this article I will describe the main pillars for your successful stock trading MVP, specifically for consumer-facing stock trading, mobile-first products:

- Stock Trading APIs

- Brokerage APIs

- Banking APIs

- Ledger APIs

- Trading infrastructure

Market’s overview

Today’s market is oversaturated with startups and established companies ready to take your money and invest them for you in different securities. Each FinTech company specializes in a different niche that provides a unique edge for your investment portfolio.

Here are main niches of existing consumer FinTech companies:

- Stock trading

- Precious metals trading

- Trading funds, commodities, options strategies, private equity

- Classic banking with saving and checking accounts

- Full-fledge banking services

- Trading cryptocurrencies

- Loans

- Insurance

- Forex

- Exchanges

There’s also an existing and established B2B FinTech market that operates between SMEs and large corporations, and another layer of FinTech companies that serve large banks and processing systems like Visa or Mastercard.

Here’s what I consider to be the top 10, in alphabetic order:

- Acorn — lets you invest the roundups monthly.

- Charles Schwab — classic trading platform.

- E*TRADE — trading subsidiary of Morgan Stanley.

- Fidelity — like Schwab, lets you trade options on top of ETFs.

- Robinhood — mobile-first trading company, first to offer free trades.

- SoFi — finance company offering services from loans to insurance.

- Stash — FinTech company founded in 2015 that allows users to invest small incremental amounts, similar to Acorn.

- StockPile — first company to sell stocks as a gift certificate.

- TD Ameritrade — subsidiary of Charles Schwab Corporation.

- WeBull — FinTech trading platform founded in 2017.

Existing APIs

First, you need to define your hypothesis of who’s your target audience. Next you need to define at least one service you need to offer to provide value to them. This decision should be backed up by user and market research.

There are several large categories of vendors you would want to consider for your venture to succeed. Here’s a map of available APIs you will need to build your FinTech product.

Extra things you’d want to consider to establish trust and simplify maintenance of your company’s product and security, both technical and financial:

- Compliances (PCI DSS, ISO 27001, ISO 9001, ISO 31000, CCPA, GDPR)

- Security

- Monitoring

- Audit processing

- FDIC

- SIPC

- FATCA

Stock Exchange Data

The evolution of API services is what makes FinTech companies today so powerful and enables them to disrupt the banking industry. Instead of waiting for the process to complete through a long bureaucratic process, you can literally do just a single API call to automate it for you. Instead of relying on human bias, you have an algorithm and big data to back up each decision your bank provider does. The centerpiece of each trading application is a functionality to pull and stream data about stocks.

Most stock API providers operate in real-time or in on-demand mode.

Besides stocks, most applications will offer you other feeds like:

- Options

- Currencies (Forex)

- Crypto

- Earnings

- Dividends

- News

- Statistics

- Key indicators

- Company information

There are two major exchanges in the US — NASDAQ and NYSE, you can implement querying data directly from them, but most companies will opt-in to work with aggregators to use the same data format and protocols to get a better deal and performance.

Some notable aggregators for stock data are:

Once you grow post your MVP phase, you will have a need to diversify the data sources and provide information about different securities via your in-house platform. That’s the time to implement a data lake that will intake data from multiple sources and enable you to query massive amounts of data in real-time.

Real-time vs On-demand

From the financial standpoint, you need to figure out if you want to provide the ability to trade in real-time (under a second) or on-demand (more than a second). Whoever places orders first and has faster access to the market will have a technical upper hand to execute trades in their favor.

Consider if you want to provide high-frequency trading (trading executed by machines in nanoseconds), which is usually outside of the consumer’s focus and is something tech-savvy customers would want to install their automated algorithms in day-to-day trading.

From a technical standpoint, you’re most likely to end up using REST API or WebSockets API since they cover on-demand and real-time use cases of streaming data and executing trade orders. There’s little to no reason to use fancy gRPC or GraphQL, but it might make sense to use the latter for more enhanced data discovery such as company information, news, statistics, earnings, etc.

REST API provides you with an on-demand way to query each specific stock ticker symbol, while WebSockets will provide the means to stream changes in real-time with the speed of the aggregator you chose. There’s always going to be latency between your customer and a stock exchange.

Note: There’s a great movie about an attempt to solve the last-mile problem of executing trades faster using fiber optics — The Hummingbird Project (2018)

After you figured out what data you want to stream and how to present it to the end-user you’ll see that some data aggregators provide you with the API to simplify the way you present data. For example, IEX Cloud and Alpaca let you batch multiple tickers into a single request, enabling your mobile client to render results by executing a single query instead of the dozens.

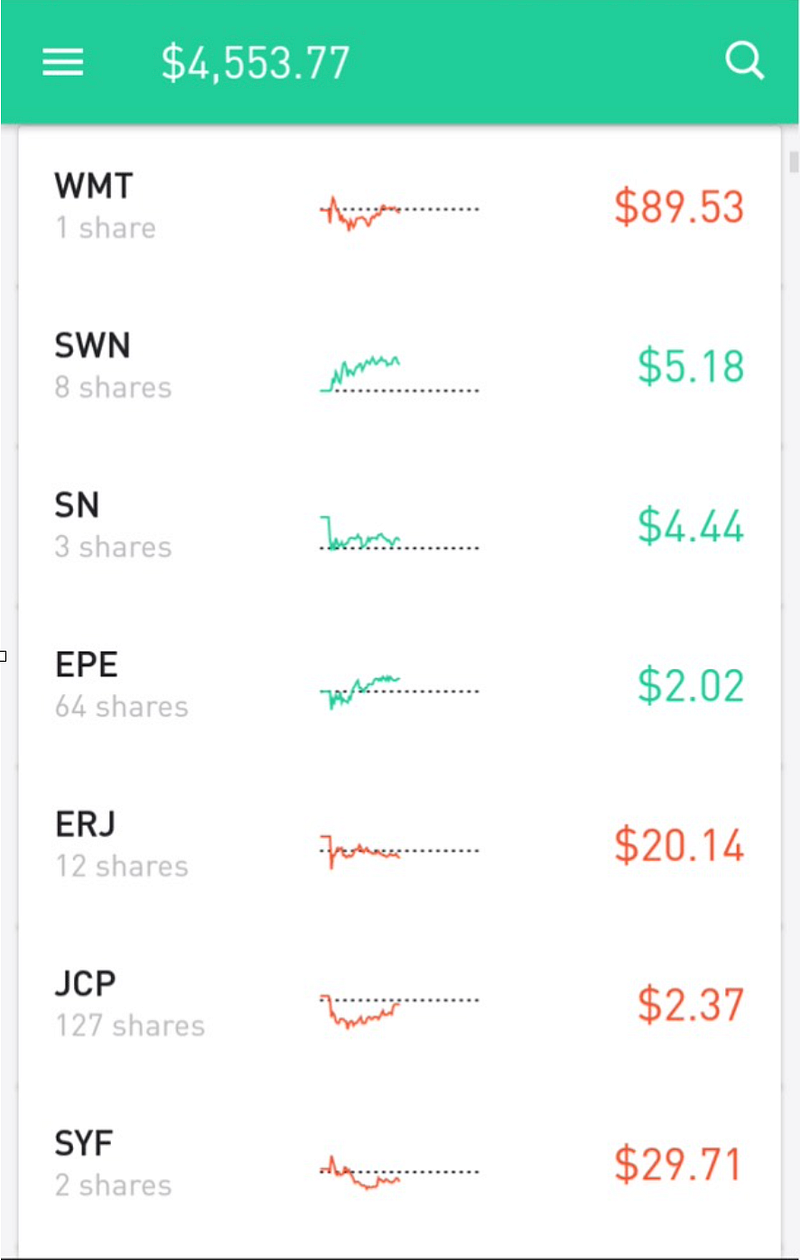

This saves you time, improves your UX, and lets you generate nicely looking screens like this:

Business model

Robinhood took off because they started offering free trades. Each trade your user makes would carry a little transaction fee you’d need to cover from your revenue by charging your customer, or by other means. In the case of Robinhood, they cover the fees by getting interest rates on the short-term cash deposits, by charging a premium for extra features (Gold), and margin interest by providing margin landing, rebates, and other means

Additionally, Robinhood covers different sorts of deals, where they sell data on the trades to different data consumers like hedge funds.

Once you figure out what your product-market fit (PMF) is and how you plan to monetize your product, you’ll need to pick the right provider for your data and trades.

For example, IEX Cloud charges you for transactions, where providers like Alpaca charge you for the data, instead of per-transaction fees.

Deposits and payouts

Only Alpaca provides something called Broker API to address the specific needs of managing customers’ accounts and their money, including transfers, journaling, ledger, assets, and so on. This functionality is a part of a common core for most FinTech companies. It so happens that Alpaca serves stock-trading products first and does it well enough to build a sustainable business model by providing Trading API and Broker API together.

As your business grows you will most likely end up implementing this functionality in-house, because your customers will want more flexibility in making the ACH payments, or having different time windows to withdraw from existing accounts, or when you decide to put in place debit cards on top of existing accounts. When you do decide to do this, you will need to build an internal ledger system to make sure you’ll be compliant with financial audits performed by FDIC and SIPC.

FDIC will let you guarantee to your customers that the cash deposits are insured under FDIC, and they are usually up to $250,000. This is something a customer expects to have from a classic bank or institution that handles cash operations.

SIPC, like FDIC, provides guarantees on the securities your customers purchased and usually cover another $250,000 of securities, on top of cash value protected by FDIC, getting the final guarantee amount to $500,000.

Galileo Financial Technologies provides FinTech companies and SMEs with their own ledger solution that will simplify your first audits to go compliant with the existing regulations. This will also simplify your accounting, taxes and give clarity to your end customer. You can opt-in to build the ledger in-house, but this will increase the size of your team drastically.

Here’s what one of my fintech clients says about delegating the ledger:

It is like hiring a team of CFOs and CPAs instead of using Xero.

Desktop vs Mobile

It is 2021, so this should be a no-brainer. In the past several decades, companies were going with a desktop-first version of the software. I remember being a kid and playing around with a sandbox Forex trading account you’d get access to only after downloading some desktop software.

Today you need to go mobile-first period.

If you’re lucky enough to get your PMF fast, you’ll have enough resources to expand your product to the Web, and cater to a wider audience. You won’t need to release a desktop version unless you’re targeting high-frequency traders that execute robot trading.

Crypto

Blockchain, blockchain, block, chain…

This is a big topic that deserves a stand-alone publication on its own.

The fact is that technical implementation for getting trading information about each cryptocurrency from each exchange is somewhat like what stock exchanges do. Luckily enough crypto exchanges don’t need to support lots of old legacy infrastructure as classic banking and stock exchanges do.

Some of the existing market leaders include:

- CoinBase Pro API

- Binance API

- HitBTC API

If you want to read more about it, let me know in the comments section below what aspect is the most exciting for your company.

International and domestic markets

I’ve led FinTech projects mainly for US and EU markets, but in the past several years there are more and more players emerging in LatAm and Asian markets, and developing markets in Africa and Asia look very interesting and promising as well.

Most of them share very similar technical executions but have different regulations. One notable initiative in the EU is Open Banking. It is a regulation that enforces all banks to make their services available via API to some extent, where end-user stands to enjoy cheaper rates and better diversity of the products and services

When you analyze market opportunities in the EU, there’s one founding story I always get back to, the story of how Wise (former TransferWise) was launched and scaled.

Where to go from here

“Software Is Eating The World” — Marc Andreessen, 2011

FinTech is no exception, since the phase was introduced by Marc Andreessen in 2011. In the past decade we got more FinTech services launched than ever. When you launch a new bank, insurance company, hedge fund, trust, you’re most likely to end up having a major technical component, and this will make your new venture a FinTech company in majority of the cases.

To succeed in launching a FinTech company you’ll need to be able to innovate fast and deliver services to your customers in real-time. And today’s variety of APIs is there to help you to achieve that in a reasonable time frame and on a budget.

While building your FinTech product is important, building your team is no less important by any means.

Once you have the first Proof of Concept (PoC) running, focus on creating a user research group and building a team of finance experts (CFO, Compliance Officers, CISO, Security and Risk analysis), so you’d be able to cement your position once you grab a piece of the oversaturated market.

Next steps

I’m working on the next publication that will show you how easy it is to build a simple stock trading mobile application and how little resources you need to create a PoC.

Please reach out in the comments if you want me to cover your use case in the next article.

About the author

Eugene is a faith-centric technologist, serial entrepreneur, angel investor, advisor, and mentor.

He is the founder and CEO of REACTIVE LIONS INC. where he is implementing his vision of faith-driven entrepreneurship in the tech world. He is currently running a team of over 40 talented engineers across the US.